Beefy.finance, the performance optimizer

What is Beefy ?

If you want to take advantage of the returns on liquidity pools, you will have to make many successive manual operations:

– you have to deposit, usually with equal distribution 50/50 on the liquidity pool between two cryptos

– you must then recover the interest, often by clicking on a button on the pool

site – finally, you must reinvest this interest by hand (by resetting your earned interest) if the "compounding" does not Is not automatic

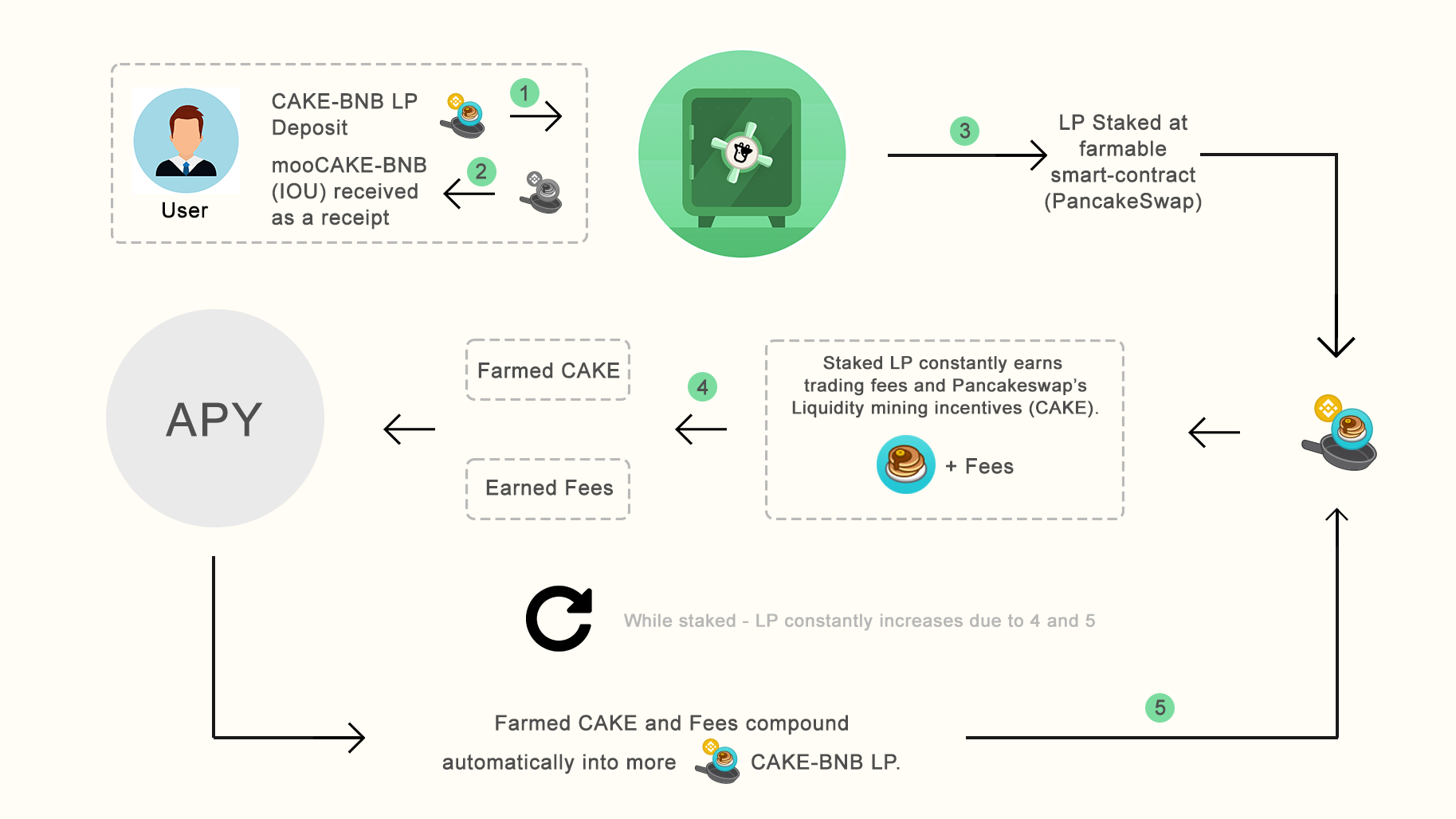

Beefy is what is called a yield optimizer. It allows, in a fairly simple way, to do all this automatically:

– Deposit crypto on a liquidity pool, in order to lend it to borrowers

– You can deposit in one of the two cryptos of the pool, a "ZAP" function allows you to automatically convert in 50/50 at an interesting

rate – Generate income thanks to the interest on loans, then to do "compounding" (producing compound interest, by reinvesting the interest earned in capital) automatically

– Withdraw his capital without delay, in one of the 2 cryptos (function "ZAP" again)

Beefy is responsible for doing all this for a remuneration.

Example of Yield Farming on Beefy, with the pair of corners $CAKE/$BNB.

What is a liquidity pool?

A liquidity pool is a pool of funds that are used to provide liquidity to a market (i.e. lend) and generate rewards in return (to lenders).

Market liquidity allows an asset to sell quickly: the more sellers and buyers there are at the same time, the more liquid it is. If there are few sellers/buyers, it is said to be illiquid: you will take time to sell your asset, and you will have to reduce its price to sell it faster.

The pool automates all this through a smart contract (Automated Market Maker) in order to adjust prices according to supply and demand, and thus ensure liquidity.